Embark on a journey into the realm of Business Risk Management Strategies Using Insurance, where businesses navigate uncertainties with strategic planning and financial protection. As risks loom large in the business landscape, understanding how insurance acts as a shield becomes paramount.

Let's delve into the intricacies of safeguarding your business through effective risk management strategies.

Importance of Business Risk Management Strategies

Implementing effective risk management strategies is crucial for businesses to safeguard their operations and assets from potential threats. By identifying, assessing, and addressing risks proactively, companies can minimize the impact of uncertainties and enhance their resilience in the face of challenges.

Potential Risks Impacting Businesses

- Market Risks: Fluctuations in demand, competition, or economic conditions can affect sales and profitability.

- Operational Risks: Issues related to processes, technology, human resources, or supply chain disruptions can lead to inefficiencies or failures.

- Financial Risks: Cash flow problems, debt obligations, or currency fluctuations can jeopardize financial stability.

- Legal and Compliance Risks: Violations of regulations, lawsuits, or intellectual property disputes can result in legal consequences.

- Reputational Risks: Negative publicity, customer dissatisfaction, or social media backlash can damage a company's reputation.

Role of Insurance in Risk Mitigation

Insurance plays a vital role in mitigating various risks faced by businesses. It provides financial protection against losses arising from unforeseen events such as natural disasters, accidents, liabilities, or lawsuits. By transferring the risk to an insurance provider, companies can reduce the financial impact of potential threats and continue their operations with greater peace of mind.

Types of Insurance Coverage for Business Risk Management

Insurance plays a crucial role in helping businesses manage various risks that they may face. There are different types of insurance coverage available to businesses, each designed to protect against specific risks. Let's explore the main types of insurance coverage for business risk management:

General Liability Insurance

General liability insurance provides coverage for third-party claims of bodily injury, property damage, and advertising injury. It helps protect businesses from legal fees, medical expenses, and settlements that may arise from these claims. This type of insurance is essential for businesses that interact with customers, clients, or the public.

Property Insurance

Property insurance covers damage or loss of physical assets, such as buildings, equipment, inventory, and other business property. It helps businesses recover from events like fires, theft, vandalism, or natural disasters. Property insurance is vital for protecting a business's physical assets and ensuring continuity of operations.

Business Interruption Insurance

Business interruption insurance helps businesses recover lost income and cover ongoing expenses when operations are disrupted due to a covered event, such as a fire, flood, or other disaster. This type of insurance can provide financial support to help a business survive during a period of interruption and resume normal operations as quickly as possible.

Comparison and Contrast

- General liability insurance focuses on protecting against claims related to third-party injuries or property damage, while property insurance covers damage to the business's physical assets.

- Business interruption insurance helps businesses recover lost income during periods of disruption, ensuring financial stability during challenging times.

- Each type of insurance coverage plays a unique role in managing specific risks that businesses may encounter, providing financial protection and peace of mind.

Risk Assessment and Insurance Needs

Risk assessment plays a crucial role in determining the insurance needs of a business. By evaluating potential risks, a business can better understand its vulnerabilities and take proactive steps to mitigate them through appropriate insurance coverage.

Conducting a Risk Assessment for a Business

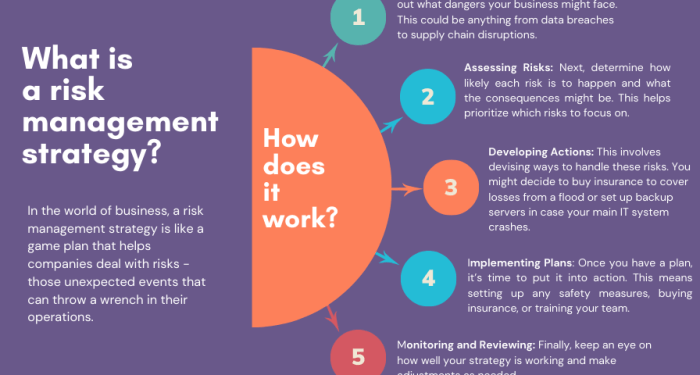

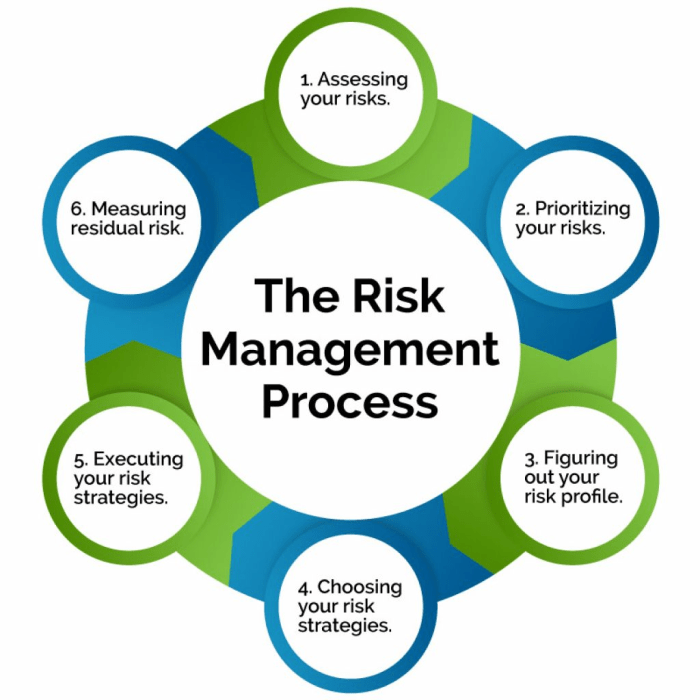

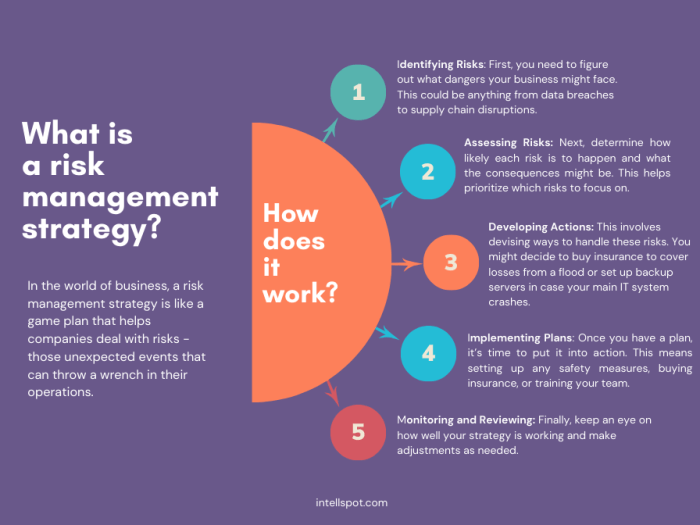

A risk assessment involves identifying, analyzing, and evaluating potential risks that could impact a business's operations, assets, or reputation. This process typically includes:

- Identifying potential risks specific to the industry, location, size, and nature of the business.

- Assessing the likelihood of these risks occurring and their potential impact.

- Developing strategies to minimize or transfer these risks through insurance.

Key Factors Determining Insurance Needs

Several key factors influence the insurance needs of a business, including:

- The nature of the business activities and operations.

- The size and scale of the business, including the number of employees and physical assets.

- The industry-specific risks that the business is exposed to.

- The regulatory requirements and compliance standards that the business must meet.

Impact of Risk Assessment on Insurance Coverage Selection

Once a business conducts a thorough risk assessment, it can tailor its insurance coverage to address the specific risks identified. For example:

- A business facing a higher likelihood of property damage due to its location may opt for property insurance to cover such risks.

- A business with a significant cyber exposure may consider cyber liability insurance to protect against data breaches.

- By aligning insurance coverage with the results of a risk assessment, a business can enhance its risk management strategy and safeguard its operations.

Claims Management and Insurance Policies

Insurance claims are an essential part of risk management for businesses. Understanding how to effectively manage claims and navigate insurance policies can help businesses recover from unexpected events and minimize financial losses.

Steps in Managing Insurance Claims

- Report the claim promptly to your insurance provider to initiate the process.

- Document all relevant information and evidence related to the claim, such as photos, receipts, and witness statements.

- Cooperate with the insurance adjuster and provide any additional information they may require to assess the claim.

- Review your insurance policy to understand coverage limits, exclusions, and deductible amounts.

- Keep track of the progress of your claim and follow up with your insurance provider as needed.

Importance of Understanding Insurance Policies and Coverage Limits

It is crucial for businesses to thoroughly understand their insurance policies and coverage limits to ensure they are adequately protected in case of a claim. Knowing what is covered, what is excluded, and the limits of coverage can help prevent surprises and ensure a smoother claims process.

Tips for Maximizing Insurance Benefits

- Educate your employees on the claims process and how to report incidents promptly.

- Work closely with your insurance agent or broker to review and update your policies regularly to reflect changes in your business.

- Consider hiring a claims management expert to assist with complex or large claims to ensure a fair and timely resolution.

- Maintain detailed records of all incidents, claims, and communications with your insurance provider for future reference.

- Seek legal advice if you encounter any challenges or disputes during the claims process to protect your rights and interests.

Emerging Trends in Business Risk Management

In today's rapidly evolving business landscape, it is crucial for organizations to stay ahead of emerging trends in risk management to safeguard their operations and assets. Let's explore some of the key trends shaping the field of business risk management.

Adoption of Artificial Intelligence and Data Analytics

With the advent of artificial intelligence and data analytics, businesses are now able to analyze vast amounts of data in real-time to identify potential risks and vulnerabilities. AI-powered risk management tools can help companies predict and prevent risks before they escalate, leading to more proactive risk mitigation strategies.

Focus on Cybersecurity Risks

As businesses increasingly rely on digital technologies, the risk of cyber threats has become a top concern. Insurance companies are now offering specialized cybersecurity insurance policies to protect businesses against data breaches, ransomware attacks, and other cyber risks. This shift reflects the growing importance of cybersecurity in overall risk management strategies.

Climate Change and Environmental Risks

The rise in natural disasters and extreme weather events due to climate change has placed a spotlight on environmental risks. Insurance companies are expanding their coverage to include environmental liability insurance, helping businesses mitigate the financial impact of environmental damage.

This trend underscores the need for businesses to assess and address environmental risks in their risk management strategies.

Globalization and Supply Chain Risks

Globalization has interconnected businesses worldwide, leading to complex supply chains that are vulnerable to disruptions. Insurance companies are introducing supply chain insurance policies to help businesses manage risks associated with global supply chains, such as supplier defaults, transportation delays, and geopolitical issues.

This trend highlights the importance of understanding and mitigating supply chain risks in today's globalized business environment.

Conclusion

In conclusion, Business Risk Management Strategies Using Insurance empowers businesses to proactively combat potential threats and secure their future. By embracing the right insurance coverage and risk assessment practices, businesses can navigate the turbulent waters of uncertainty with confidence. Stay informed, stay protected, and thrive in the ever-changing business environment.

Query Resolution

What are some common risks that businesses face?

Common risks include financial losses, natural disasters, cyber threats, and legal liabilities.

How does insurance help in managing specific risks?

Insurance provides financial protection and compensation in case of covered risks, reducing the impact on businesses.

What factors determine a business's insurance needs?

Factors such as the nature of the business, its size, location, and industry risks play a crucial role in determining insurance needs.

How can businesses maximize insurance benefits during the claims process?

Businesses can maximize benefits by understanding their policy coverage, documenting losses accurately, and promptly filing claims.

What are some emerging trends in business risk management?

Emerging trends include leveraging technology for risk assessment, adapting insurance policies to cover cyber threats, and addressing risks posed by globalization.