When comparing Term vs Whole Life Insurance: Which Is Better?, we delve into a crucial decision that impacts financial planning and security. Let's explore the nuances of each insurance type to determine the best fit for individual needs.

The following paragraphs will break down the key differences and benefits of term and whole life insurance, shedding light on the intricacies of each.

Term Life Insurance

Term life insurance is a type of life insurance policy that provides coverage for a specific period of time, known as the term. If the insured individual passes away during the term of the policy, a death benefit is paid out to the beneficiaries.

However, if the insured individual outlives the term, no benefits are paid out.

When Term Life Insurance is Most Beneficial

- For individuals looking for temporary coverage, such as to cover a mortgage or provide for children until they are financially independent.

- For those on a budget, as term life insurance premiums are typically lower compared to whole life insurance.

- For individuals who want to supplement their employer-provided life insurance coverage.

Cost Comparison: Term Life Insurance vs Whole Life Insurance

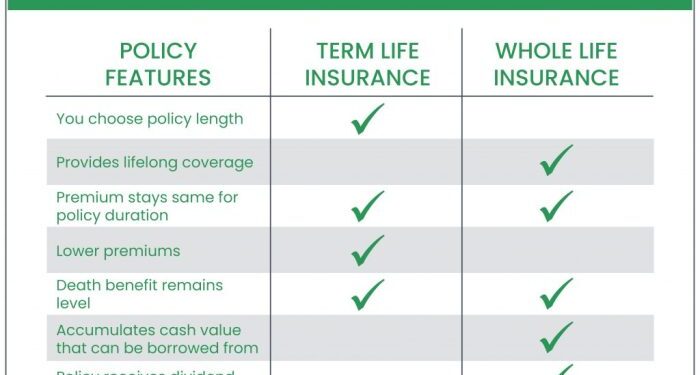

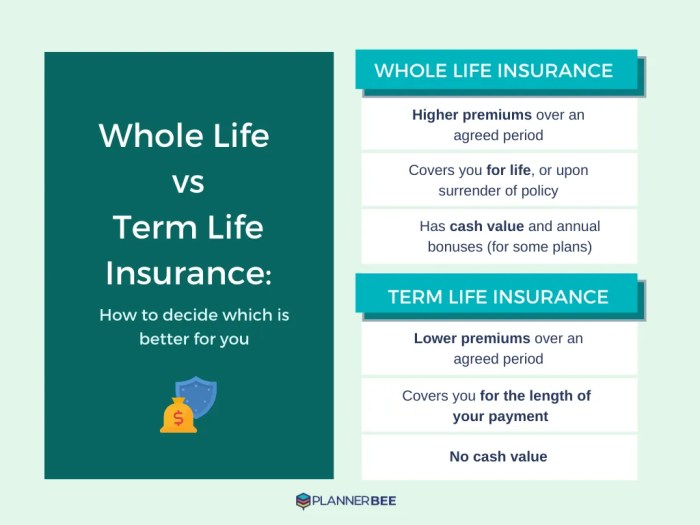

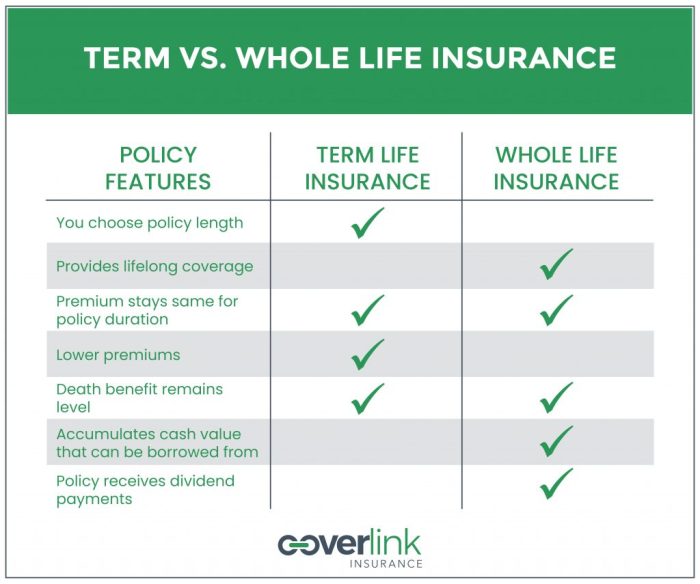

Term life insurance is generally more affordable than whole life insurance. Since term life insurance only provides coverage for a specific period of time, the premiums are lower. Whole life insurance, on the other hand, provides coverage for the entire lifetime of the insured individual and includes a cash value component, making it more expensive.

It is important to consider your budget, financial goals, and coverage needs when deciding between the two types of insurance.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the policyholder, as long as premiums are paid. Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers a death benefit along with a cash value component that grows over time.

Key Features of Whole Life Insurance

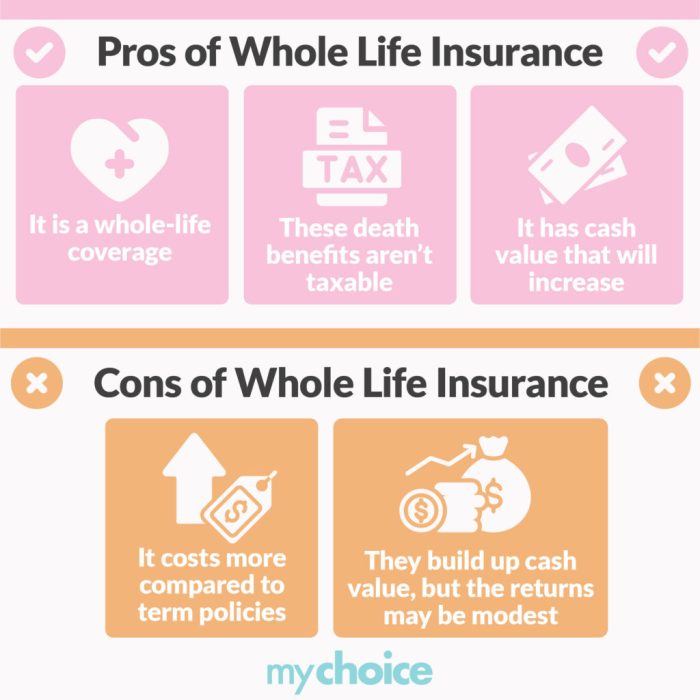

- Guaranteed Death Benefit: Whole life insurance provides a guaranteed death benefit to the beneficiaries upon the death of the policyholder.

- Cash Value Accumulation: A portion of the premium paid towards whole life insurance goes towards building cash value, which grows over time on a tax-deferred basis.

- Lifetime Coverage: Whole life insurance offers coverage for the entire lifetime of the insured, providing peace of mind that beneficiaries will receive a payout whenever the insured passes away.

- Premiums: Premiums for whole life insurance are typically higher than term life insurance but remain level throughout the life of the policy.

Benefits of Whole Life Insurance Compared to Term Life Insurance

- Permanent Coverage: Whole life insurance provides coverage for life, ensuring that beneficiaries receive a death benefit no matter when the policyholder passes away.

- Cash Value Growth: The cash value component of whole life insurance grows over time, providing a savings and investment vehicle in addition to the death benefit.

- Fixed Premiums: Premiums for whole life insurance remain fixed throughout the life of the policy, offering predictability and stability in financial planning.

- Estate Planning: Whole life insurance can be used as a tool for estate planning, providing liquidity to pay estate taxes and ensuring a smooth transfer of assets to beneficiaries.

Using Whole Life Insurance as an Investment Tool

- Dividends: Some whole life insurance policies pay dividends, which can be used to purchase additional coverage, reduce premiums, or accumulate cash value.

- Tax-Advantaged Growth: The cash value component of whole life insurance grows on a tax-deferred basis, allowing policyholders to accumulate wealth without immediate tax implications.

- Loan Option: Policyholders can borrow against the cash value of their whole life insurance policy, providing a source of liquidity for emergencies or investments.

Coverage and Flexibility

Term life insurance typically offers straightforward coverage for a specified period, usually ranging from 10 to 30 years. During this time, if the policyholder passes away, their beneficiaries receive a lump sum death benefit. This type of insurance is often chosen for its affordability and simplicity, providing protection during the policy term.

Coverage Options with Term Life Insurance

Term life insurance policies offer various coverage options, including:

- Level term: Fixed premiums and death benefit throughout the policy term.

- Decreasing term: Death benefit decreases over time, often used to cover specific loans or mortgages.

- Renewable term: Option to renew the policy at the end of the term without additional medical underwriting.

- Convertible term: Ability to convert to a whole life policy without a medical exam.

Flexibility of Whole Life Insurance Policies

Whole life insurance provides coverage for the entire lifetime of the insured, as long as premiums are paid. Unlike term life insurance, whole life policies come with a cash value component that grows over time. This cash value can be used for loans, withdrawals, or even to pay premiums

Scenarios Where Term Life Insurance Coverage Falls Short

While term life insurance offers affordable protection, there are situations where its coverage may not be sufficient:

- If the policyholder outlives the term, no death benefit is paid out.

- If the policyholder develops a serious health condition, renewing or obtaining a new term policy may be costly or unavailable.

- If the policyholder needs coverage beyond the term length, they may face challenges in securing new coverage at an older age.

Cost and Premiums

When it comes to life insurance, understanding the cost and premiums associated with different types of policies is crucial for making an informed decision about your financial future.

Term Life Insurance Premiums

Term life insurance premiums are typically lower compared to whole life insurance because they cover a specific period, such as 10, 20, or 30 years. The premiums for term life insurance are determined based on factors like the insured individual's age, health, coverage amount, and term length.

Younger and healthier individuals usually pay lower premiums for term life insurance.

Whole Life Insurance Cost Structure

Whole life insurance premiums are generally higher than term life insurance premiums because they provide coverage for the entire lifetime of the insured individual. The cost structure of whole life insurance premiums includes not only the insurance coverage but also a cash value component that grows over time.

Premiums for whole life insurance are determined based on the insured individual's age, health, coverage amount, and the insurer's financial projections.

Impact on Long-Term Financial Planning

The costs of both types of insurance can have a significant impact on long-term financial planning. While term life insurance may offer more affordable premiums, it may not provide the same level of coverage or financial benefits as whole life insurance.

Whole life insurance, on the other hand, can serve as a valuable asset with its cash value component and lifelong coverage, but it comes at a higher cost. Understanding how the costs and premiums of term and whole life insurance fit into your overall financial goals and needs is essential for securing your financial future.

Suitability and Considerations

When deciding between term and whole life insurance, there are several factors to consider to ensure you select the most suitable option based on your individual needs and financial goals. Here are some key considerations:

Financial Goals

- Consider your long-term financial goals when choosing between term and whole life insurance. If you have specific financial objectives, such as providing for your family's future, building cash value, or covering estate taxes, whole life insurance may be more suitable.

- On the other hand, if you are looking for temporary coverage to protect your loved ones during a specific period, such as paying off a mortgage or funding your children's education, term life insurance might be a better fit.

Risk Tolerance

- Assess your risk tolerance before making a decision. Whole life insurance offers lifelong coverage and a cash value component, but it comes with higher premiums. If you prefer a more affordable option with flexibility to adjust coverage as needed, term life insurance could be a better choice.

Budget and Affordability

- Consider your budget and financial situation when evaluating term and whole life insurance. Whole life insurance typically has higher premiums due to the cash value feature, while term life insurance offers more affordable rates for a specific term length.

- Evaluate how much you can comfortably afford to pay for insurance premiums without straining your finances to ensure you can maintain coverage for the desired period.

Closure

As we conclude the discussion on Term vs Whole Life Insurance: Which Is Better?, it becomes evident that the choice between the two depends on personal circumstances and financial goals. Understanding these nuances is essential for making an informed decision regarding insurance coverage.

Essential Questionnaire

Is term life insurance always cheaper than whole life insurance?

Yes, term life insurance is generally more affordable compared to whole life insurance due to its temporary coverage nature.

Can whole life insurance be used as an investment tool?

Yes, whole life insurance can serve as an investment tool with cash value accumulation over the policy's lifetime.

What factors should be considered when choosing between term and whole life insurance?

Factors such as budget, coverage needs, and long-term financial objectives play a crucial role in deciding between the two insurance types.