Delving into the realm of Understanding Insurance Deductibles and Copays, we embark on a journey that unravels the complexities of these crucial aspects of insurance coverage. Brace yourself for an informative exploration that will shed light on how deductibles and copays impact your healthcare expenses.

In the following paragraphs, we will navigate through the intricacies of insurance deductibles and copays, offering valuable insights and practical tips to help you navigate this often confusing terrain with confidence.

Understanding Insurance Deductibles

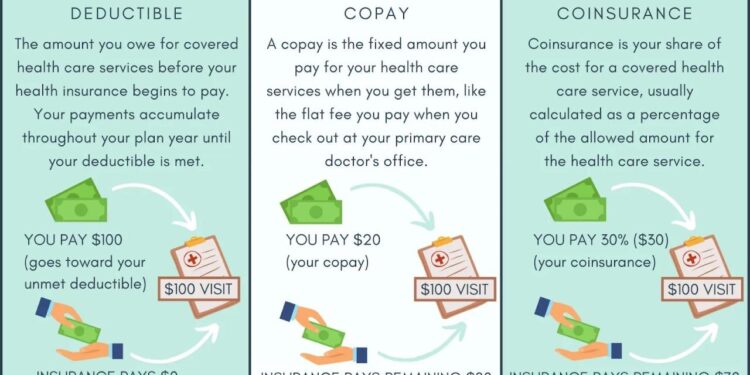

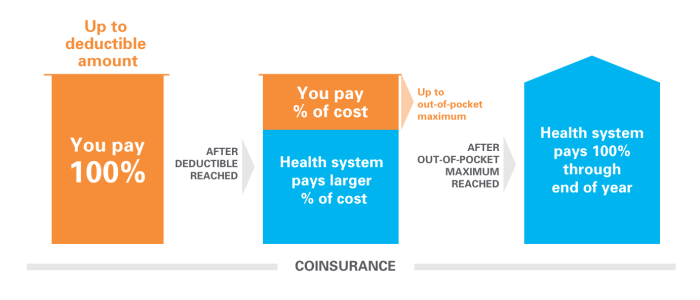

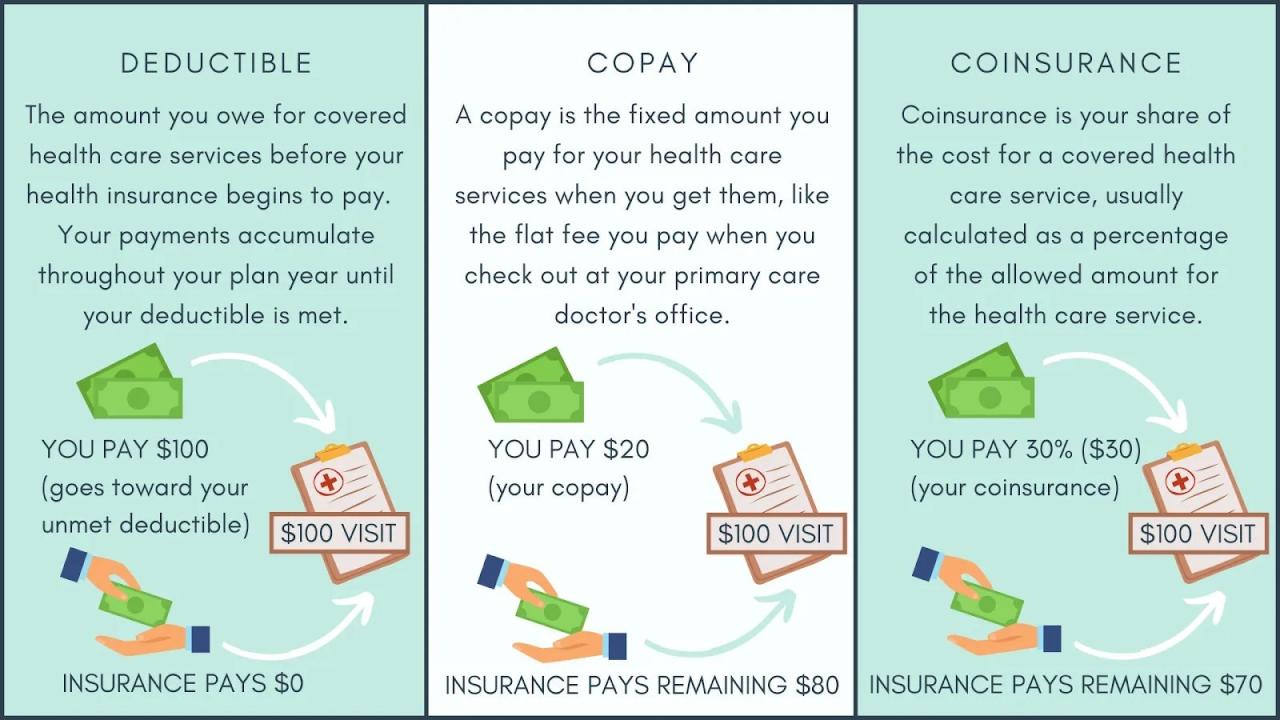

An insurance deductible is the amount of money an individual has to pay out of pocket before their insurance company begins to cover costs. It is a fixed amount that the policyholder must pay before the insurance company pays for covered services.

How Deductibles Work

- For example, if you have a health insurance plan with a $1,000 deductible and you need to undergo a medical procedure that costs $2,000, you would need to pay the first $1,000, and then the insurance company would cover the remaining $1,000.

- Deductibles typically reset annually, meaning you have to meet the deductible again each year before your insurance company starts covering costs.

Varying Deductibles

- Deductibles can vary widely based on insurance plans. Some plans have low deductibles, such as $500, while others have high deductibles, like $5,000 or more.

- High deductible plans often have lower monthly premiums, but require you to pay more out of pocket before the insurance company starts covering costs.

Relationship with Premiums

- There is an inverse relationship between deductibles and insurance premiums. Plans with lower deductibles tend to have higher monthly premiums, while plans with higher deductibles have lower premiums.

- Individuals need to consider their healthcare needs and budget when choosing between high and low deductible plans.

High vs. Low Deductible Plans

- High deductible plans are more suitable for individuals who are healthy and do not anticipate needing many medical services throughout the year.

- Low deductible plans are better for individuals who expect to use medical services frequently and want to have lower out-of-pocket costs upfront.

Understanding Insurance Copays

In the context of insurance, a copay refers to a fixed amount that an individual pays for a covered healthcare service at the time of receiving the service. It is a predetermined cost-sharing arrangement between the policyholder and the insurance company.

Common Copay Amounts for Different Types of Medical Services

- Primary care physician visit: $20

- Specialist visit: $50

- Urgent care visit: $75

- Generic prescription drugs: $10

- Brand-name prescription drugs: $30

How Copays Differ from Coinsurance

Copays are fixed amounts that policyholders pay for specific healthcare services, while coinsurance is a percentage of the total cost of a covered service that the policyholder is responsible for paying. Copays are more straightforward and predictable compared to coinsurance.

Contribution to Out-of-Pocket Costs

Copays contribute to the out-of-pocket costs for policyholders, along with coinsurance and deductibles. These costs are what the individual is responsible for paying in addition to the premiums. Copays help make healthcare costs more manageable by spreading them out over time.

Factors Influencing Deductibles and Copays

When it comes to insurance deductibles and copays, there are several factors that can influence the amounts policyholders are required to pay. Understanding these factors is crucial in navigating the complexities of healthcare costs and making informed decisions.

Factors Affecting Deductibles

- Insurance Plan Type: Different insurance plans, such as HMOs, PPOs, or high-deductible plans, may have varying deductible amounts based on the coverage provided.

- Premium Costs: Plans with lower monthly premiums often come with higher deductibles, while plans with higher premiums may have lower deductibles.

- Policyholder Age: Older policyholders may face higher deductibles due to a higher likelihood of needing healthcare services.

- Healthcare Utilization: Policyholders who frequently use healthcare services may opt for plans with lower deductibles to reduce out-of-pocket costs.

Determining Copay Amounts

- Insurance Company Guidelines: Insurance companies establish copay amounts based on factors such as the type of medical service, specialist visits, or prescription drugs.

- Plan Design: Different insurance plans may have set copay amounts for primary care visits, specialist visits, or emergency room visits.

- Covered Services: Copay amounts can vary depending on whether the service is considered preventive care, diagnostic care, or treatment.

Influence of Healthcare Providers

- Contract Negotiations: Healthcare providers negotiate contracts with insurance companies that can impact copay rates for services rendered.

- Network Participation: Providers within a specific insurance network may offer lower copays to attract patients within that network.

- Specialty Services: Copay amounts for specialist visits or procedures may be higher due to the expertise and resources required for specialized care.

Policyholder Choices and Impact

- Plan Selection: Policyholders have the option to choose insurance plans with higher or lower deductibles and copays based on their healthcare needs and budget.

- Utilization Patterns: Policyholders who understand their healthcare needs can make informed choices that align with their expected healthcare expenses.

- Health Savings Accounts: Policyholders with high-deductible plans can use HSAs to save for medical expenses and reduce the impact of deductibles and copays.

Strategies for Managing Deductibles and Copays

Choosing between high and low deductible plans can be a crucial decision when it comes to managing healthcare costs. Here are some tips to help you make an informed choice and save money on copayments for medical services.

Choosing Between High and Low Deductible Plans

- Consider your health status and medical needs: If you anticipate frequent medical visits or have a chronic condition, a low deductible plan may be more cost-effective in the long run.

- Assess your financial situation: If you have enough savings to cover a higher deductible in case of an emergency, opting for a high deductible plan with lower monthly premiums could save you money.

- Compare out-of-pocket maximums: Look at the maximum amount you would have to pay in a year under each plan, including deductibles and copays, to determine which option offers better overall savings.

Saving Money on Copayments

- Use in-network providers: Visiting healthcare providers within your insurance network can significantly reduce copayments and out-of-pocket costs.

- Consider telemedicine options: Virtual visits can be a cost-effective alternative to in-person appointments, with lower copays for certain services.

- Explore prescription drug discounts: Some pharmacies offer savings programs and discounts on medications that can help lower copayments for prescription drugs.

Utilizing Health Savings Accounts (HSAs)

- Contribute to your HSA regularly: By setting aside pre-tax dollars in an HSA, you can use the funds to pay for qualified medical expenses, including deductibles and copays.

- Take advantage of employer contributions: If your employer offers matching contributions to your HSA, maximize this benefit to further offset out-of-pocket costs.

- Save for the future: Any unused funds in an HSA can roll over from year to year, allowing you to build a financial cushion for future healthcare expenses.

Negotiation Strategies for Reducing Medical Bills

- Review your medical bills for errors: Mistakes in billing can lead to overcharges, so carefully examine each statement and dispute any inaccuracies with your healthcare provider or insurer.

- Ask for discounts or payment plans: Many healthcare facilities are willing to offer discounts or set up payment arrangements for patients facing financial hardship, so don't hesitate to negotiate for lower costs.

- Seek assistance from patient advocacy services: Organizations specializing in medical bill advocacy can help you navigate the billing process, identify cost-saving opportunities, and negotiate on your behalf.

Final Thoughts

As we conclude our discussion on Understanding Insurance Deductibles and Copays, we hope you have gained a deeper understanding of how these elements shape your healthcare costs. Remember, being informed and proactive about your insurance coverage can lead to better financial decisions and improved peace of mind.

FAQ Overview

What factors can influence the amount of deductibles in insurance plans?

Factors such as age, location, type of coverage, and insurance company policies can all play a role in determining the deductible amount.

How do copays differ from coinsurance?

Copays are fixed amounts that you pay for covered services, while coinsurance is a percentage of the cost that you are responsible for after meeting your deductible.

Can policyholders negotiate copay rates with healthcare providers?

In some cases, policyholders may be able to negotiate copay rates with healthcare providers, especially if they are paying out-of-pocket for services.

What are some strategies for managing high deductibles and copays?

Consider choosing a plan with lower premiums but higher deductibles, utilize health savings accounts (HSAs) to save for medical expenses, and explore negotiation options with providers to reduce costs.