Exploring the realm of Professional Indemnity Insurance in Consulting, this introduction sets the stage for a deep dive into this crucial aspect of business protection.

As we navigate through the intricacies of this insurance type, we aim to shed light on its significance, coverage details, cost factors, claims process, and its pivotal role in risk management within the consulting industry.

Introduction to Professional Indemnity Insurance in Consulting

Professional Indemnity Insurance is a type of insurance coverage that protects consulting firms and individual consultants against claims of negligence, errors, or omissions in the services they provide. It provides financial protection in case a client files a lawsuit for damages resulting from professional advice or services rendered.Professional Indemnity Insurance is crucial for consulting firms as it helps mitigate the financial risks associated with potential legal claims.

Without this insurance, consultants may have to bear the full cost of legal defense and any settlements or judgments awarded to the claimant.

Importance of Professional Indemnity Insurance for Consulting Firms

- Professional Indemnity Insurance safeguards the reputation and financial stability of consulting firms by covering legal costs and damages resulting from professional liabilities.

- It instills confidence in clients as it demonstrates that the consulting firm is committed to delivering high-quality services and is prepared to take responsibility for any mistakes or oversights.

- Professional Indemnity Insurance is often a requirement for consulting firms to secure contracts with clients or to comply with industry regulations.

Scenarios Where Professional Indemnity Insurance is Crucial for Consultants

- Providing incorrect advice that leads to financial losses for a client.

- Failing to deliver services as promised, resulting in project delays or failures.

- Making errors or omissions in reports or recommendations that cause harm to a client's business.

Coverage Details

Professional Indemnity Insurance typically covers the costs associated with legal defense, settlements, and judgments resulting from claims of errors, negligence, or professional misconduct in consulting services. This type of insurance is essential for consultants as it protects them from financial losses due to potential lawsuits.

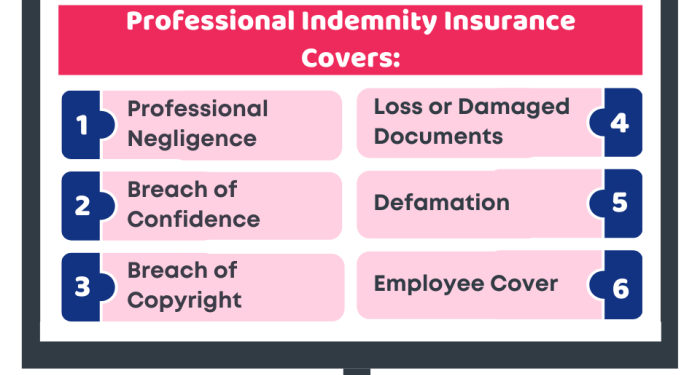

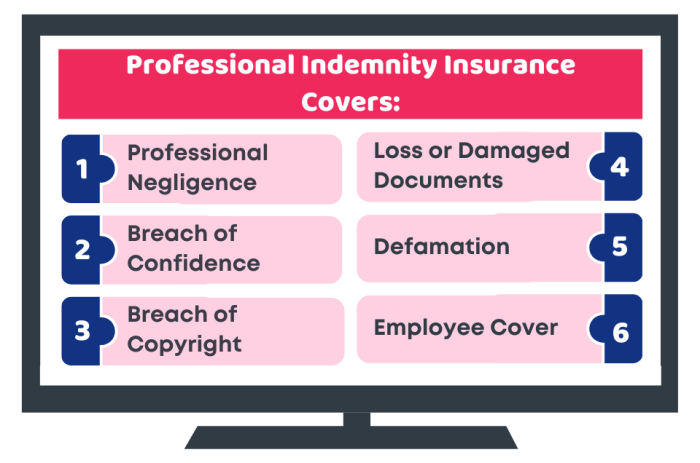

Typical Coverage Provided

Professional Indemnity Insurance usually covers legal expenses, court costs, and compensation payments in the event a consultant is found liable for a client's financial loss resulting from professional advice or services. It may also include coverage for defamation, breach of confidentiality, and intellectual property infringement claims.

Limits of Coverage

The limits of coverage in Professional Indemnity Insurance are determined based on the specific needs of the consultant and the risks associated with their consulting services. These limits are usually set as a maximum amount that the insurance company will pay out for a claim or series of claims during the policy period.

Consultants should carefully consider their coverage limits to ensure they are adequately protected.

Difference from Other Business Insurance

Professional Indemnity Insurance differs from other types of business insurance, such as General Liability Insurance or Property Insurance, in that it specifically covers claims related to professional services and advice. While General Liability Insurance may cover bodily injury or property damage claims, Professional Indemnity Insurance focuses on protecting consultants from financial losses due to professional errors or negligence.

Cost Factors

When it comes to Professional Indemnity Insurance in consulting, the cost can vary depending on several key factors. Understanding these factors is crucial for consultants looking to manage and reduce the cost of their insurance coverage.

Factors Influencing Cost

- The level of coverage required: The more coverage you need, the higher the cost of the insurance policy. Consultants working on high-risk projects may require more coverage, impacting the overall cost.

- Consulting specialization: Different consulting specializations may have varying levels of risk associated with them. As a result, the cost of Professional Indemnity Insurance can differ across specializations.

- Claims history: Consultants with a history of claims may face higher premiums as they are considered higher risk. Taking steps to minimize claims can help reduce insurance costs over time.

- Business size and revenue: The size of your consulting business and the revenue it generates can also influence the cost of Professional Indemnity Insurance. Larger businesses may face higher premiums due to increased exposure.

Comparing Costs Across Specializations

- IT consulting: Due to the rapidly changing nature of technology and the potential for data breaches, IT consultants may face higher insurance costs compared to other specializations.

- Management consulting: Consultants specializing in management may have lower insurance costs as the risks associated with this field are generally lower.

- Legal consulting: Legal consultants may experience higher insurance costs due to the legal nature of their work and the potential for lawsuits.

Strategies for Cost Management

- Implement risk management practices: By proactively managing risks in your consulting practice, you can reduce the likelihood of claims and potentially lower your insurance costs.

- Review and update coverage regularly: Regularly reviewing your coverage needs can help ensure you are not paying for more insurance than necessary, helping to manage costs.

- Compare quotes from different insurers: Shopping around for insurance quotes and comparing coverage options can help you find the most cost-effective policy for your consulting business.

- Consider higher deductibles: Opting for a higher deductible can lower your insurance premiums, but it's important to ensure you can afford the deductible in the event of a claim.

Claims Process

When it comes to filing a claim under Professional Indemnity Insurance, there are specific steps that need to be followed to ensure a smooth process and avoid common pitfalls.

Steps Involved in Filing a Claim

- Notify your insurance provider as soon as you become aware of a potential claim. Timely reporting is crucial.

- Gather all relevant documentation to support your claim, including contracts, project details, and communication records.

- Submit a detailed claim form provided by your insurer, outlining the circumstances of the claim and the damages incurred.

- Cooperate with the insurance company's investigation and provide any additional information or evidence they may request.

- Stay in communication with your insurer throughout the process and follow up on the status of your claim regularly.

Tips for Ensuring a Smooth Claims Process

- Keep detailed records of all projects and client interactions to have a clear documentation trail in case of a claim.

- Understand your policy coverage and exclusions to ensure you file a claim that falls within the scope of your insurance.

- Work closely with your insurance provider and provide all necessary information promptly to avoid delays in processing your claim.

Common Pitfalls to Avoid When Filing a Claim

- Missing the deadline for reporting a claim can result in denial of coverage, so make sure to notify your insurer promptly.

- Exceeding the limits of your policy coverage can leave you exposed to additional costs, so be aware of your policy limits.

- Providing incomplete or inaccurate information in your claim form can lead to delays or denial of your claim, so ensure all details are correct.

Importance of Professional Indemnity Insurance in Risk Management

Professional Indemnity Insurance plays a crucial role in overall risk management for consulting firms. By providing financial protection against potential claims of negligence or errors, this type of insurance helps consultants mitigate the risks associated with their professional services.

Financial Protection and Risk Mitigation

Professional Indemnity Insurance can protect consultants from substantial financial loss in the event of a lawsuit or claim alleging errors, omissions, or negligence in their services. For example, if a consultant provides advice that leads to financial loss for a client, the insurance can cover legal fees, settlements, or damages awarded.

Business Continuity and Reputation Management

In the consulting industry, maintaining business continuity is essential for long-term success. Professional Indemnity Insurance helps ensure that consultants can continue operating even in the face of unexpected legal challenges. By safeguarding against potential financial setbacks, this insurance also protects the reputation and credibility of the consulting firm.

Last Word

In conclusion, we've unraveled the layers of Professional Indemnity Insurance in Consulting, emphasizing its indispensable nature for consultants. From understanding coverage nuances to grasping cost implications, this insurance stands as a vital safeguard in the consultancy landscape.

Question & Answer Hub

What does Professional Indemnity Insurance cover?

Professional Indemnity Insurance typically covers legal costs and compensation claims if a client alleges negligence or mistakes in your services.

How are limits of coverage determined for Professional Indemnity Insurance?

Limits of coverage are usually based on factors like the size of your business, industry risks, and previous claim history.

Can Professional Indemnity Insurance protect against financial loss?

Yes, this insurance can shield consultants from significant financial losses resulting from legal claims or disputes.