Why Business Interruption Insurance Is Crucial in 2025 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

As we delve into the intricacies of business interruption insurance and its pivotal role in protecting businesses, we uncover a tapestry of scenarios where this coverage becomes a lifeline in times of crisis.

Importance of Business Interruption Insurance

Business interruption insurance is a crucial policy that helps businesses cover lost income and expenses during periods when they are unable to operate due to unexpected events. This type of insurance provides financial protection beyond the scope of property insurance, which typically covers physical damage to the business premises.

Protection Against Revenue Loss

- Business interruption insurance can help cover lost revenue resulting from a fire, natural disaster, or other unforeseen events that force a business to temporarily close.

- For example, if a restaurant has to shut down due to a fire, business interruption insurance can cover ongoing expenses such as payroll, rent, and utility bills, ensuring the business can survive until it reopens.

Continuity of Operations

- Having business interruption insurance in place ensures that a business can continue to pay its employees and meet financial obligations even when operations are disrupted.

- This can be especially important for small businesses that may not have significant cash reserves to sustain them through a prolonged closure.

Peace of Mind for Business Owners

- Knowing that they have business interruption insurance can provide business owners with peace of mind, allowing them to focus on recovery and rebuilding efforts rather than worrying about financial losses.

- In uncertain times, having this safety net can make a significant difference in the resilience and survival of a business.

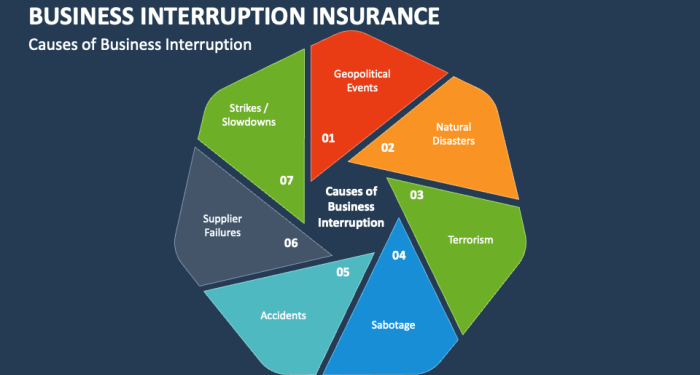

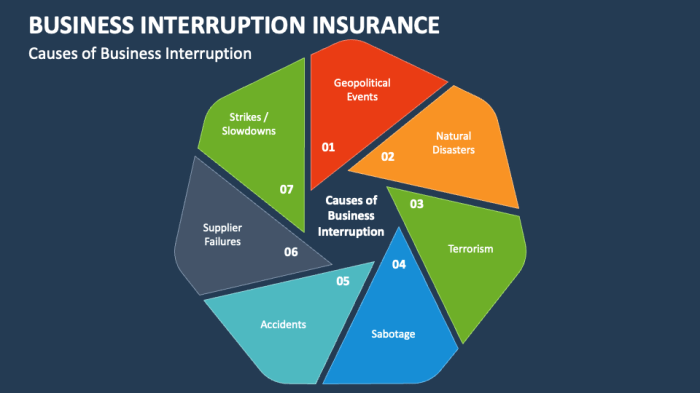

Factors Influencing Business Interruption Insurance Needs

Business interruption insurance needs can vary based on several factors that impact a company's operations and risks. These factors play a crucial role in determining the necessity for this type of insurance coverage.

Industry Type

The type of industry a business operates in can significantly influence the need for business interruption insurance. Industries that are more susceptible to external risks such as natural disasters, supply chain disruptions, or regulatory changes may have a higher need for this coverage.

For example, businesses in the hospitality or manufacturing sectors may face higher risks of interruptions due to various factors, making business interruption insurance more crucial for them.

Geographic Location and External Factors

Geographic location can also play a key role in determining the need for business interruption insurance. Businesses located in regions prone to natural disasters such as hurricanes, earthquakes, or wildfires may require this coverage to protect against the financial impact of such events.

External factors like political instability, economic downturns, or pandemics can also impact the need for business interruption insurance, as they can disrupt operations and revenue streams.

Trends and Changes in Business Interruption Insurance by 2025

Business interruption insurance is constantly evolving to adapt to the changing landscape of risks faced by businesses. By 2025, several trends and changes are expected to shape the future of this essential coverage.

Increased Focus on Cyber Risks

With the rise of cyber threats and data breaches, businesses are increasingly vulnerable to interruptions caused by cyber incidents. As a result, business interruption insurance policies are likely to include specific coverage for cyber-related disruptions by 2025. This shift reflects the growing importance of protecting businesses from the financial impact of cyberattacks.

Parametric Insurance Solutions

Parametric insurance, which pays out a predetermined amount based on specific triggers such as a natural disaster or pandemic, is gaining popularity in the insurance industry. By 2025, business interruption policies may incorporate parametric solutions to provide more efficient and transparent coverage for interruptions caused by external events.

Integration of Artificial Intelligence

Advancements in technology, particularly artificial intelligence, are expected to revolutionize the insurance industry. By leveraging AI capabilities, insurers can better assess risks, streamline claims processing, and improve the overall efficiency of business interruption insurance. In the coming years, AI integration may lead to more customized policies tailored to individual business needs.

Climate Change Considerations

The increasing frequency and severity of natural disasters due to climate change are impacting businesses worldwide

Collaboration with Insurtech Companies

The rise of insurtech companies, which leverage technology to innovate and improve insurance processes, is reshaping the insurance landscape. By 2025, traditional insurers may collaborate more closely with insurtech firms to enhance the design and delivery of business interruption insurance products.

This collaboration could lead to more flexible, digital-first solutions that better meet the evolving needs of businesses in a rapidly changing world.

Case Studies and Real-World Examples

Business interruption insurance has proven to be crucial for many businesses, providing financial protection when unexpected events cause operations to cease. Let's explore some real-world examples to understand the impact of having or lacking this type of insurance.

Benefited Businesses

- A small manufacturing company in the Midwest experienced a fire that destroyed its production facility. Thanks to their business interruption insurance, they were able to cover ongoing expenses and maintain cash flow while rebuilding.

- A popular restaurant in a coastal town was forced to close for several weeks due to a hurricane. With business interruption insurance, they were able to compensate for lost income and retain key employees during the recovery period.

Financial Losses from Lack of Insurance

- A retail store in a busy city center suffered water damage from a burst pipe, leading to temporary closure. Without business interruption insurance, they faced significant financial losses from the inability to generate revenue during repairs.

- A tech startup experienced a cyber-attack that disrupted their online services for weeks. The lack of business interruption insurance meant they had to cover all expenses and lost income out of pocket, impacting their growth trajectory.

Learning from Examples

- Businesses can learn from these examples that unexpected events can disrupt operations and lead to financial strain. Having business interruption insurance can provide a safety net to cover expenses and maintain stability during challenging times.

- By analyzing these case studies, businesses can make informed decisions about the importance of investing in business interruption insurance to protect themselves from unforeseen circumstances that could threaten their livelihood.

Last Word

In conclusion, the essence of why Business Interruption Insurance Is Crucial in 2025 lies in its ability to shield businesses from the unpredictable and ensure continuity in the face of adversity. As we navigate the evolving landscape of insurance needs, embracing this crucial aspect will undoubtedly pave the way for a more resilient and secure future for businesses worldwide.

Query Resolution

What does business interruption insurance cover?

Business interruption insurance typically covers lost income, operating expenses, and relocation costs during a temporary closure due to covered perils.

Is business interruption insurance mandatory for all businesses?

Business interruption insurance is usually optional, but it is highly recommended for businesses of all sizes to mitigate financial risks during unforeseen disruptions.

How does industry type impact the need for business interruption insurance?

Industries with higher risk of disruptions, such as manufacturing or retail, may have a greater need for business interruption insurance compared to less volatile sectors.